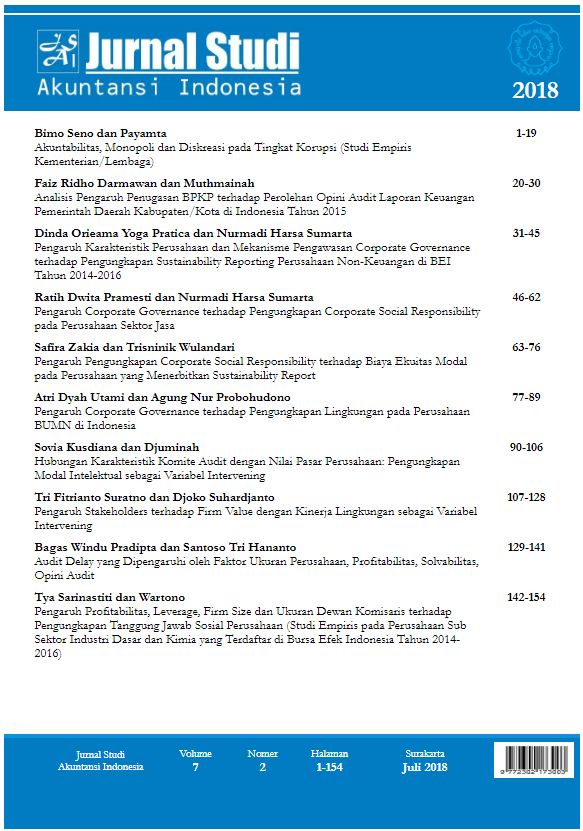

Kembali | Vol 7, No 2 (2018)

Article

Sovia Kusdiana dan Djuminah

Abstract

The purpose of this study is to examine the role of intellectual capital disclosure as intervening variable on the relationship of audit committee characteristic and corporate market value. This study applies the agency and signaling theory in formulating seven hypotheses. The study uses secondary data for 119 Intellectual Capital Intensive companies that listed in BEI for the year 2016. Using path analysis, this research find that audit committee size has a significant positive effect on corporate market value, but there’s no effect of audit committee meetings on corporate market value. On the other side, size and meetings have a positive significant effect on intellectual capital disclosure. Furthermore, the intellectual capital disclosure has a positive significant effect on the corporate market value which measured by market capitalization. However, intellectual capital disclosure cannot mediate the relationship between audit committee size and market value, while the relationship of audit committee meetings and market value can mediated by intellectual capital disclosure.

Keywords

Audit Committee Characteristic; Intellectual Capital Intensive Industry; Intellectual Capital Disclosure; Market Capitalization