Kembali | Vol 7, No 2 (2018)

Article

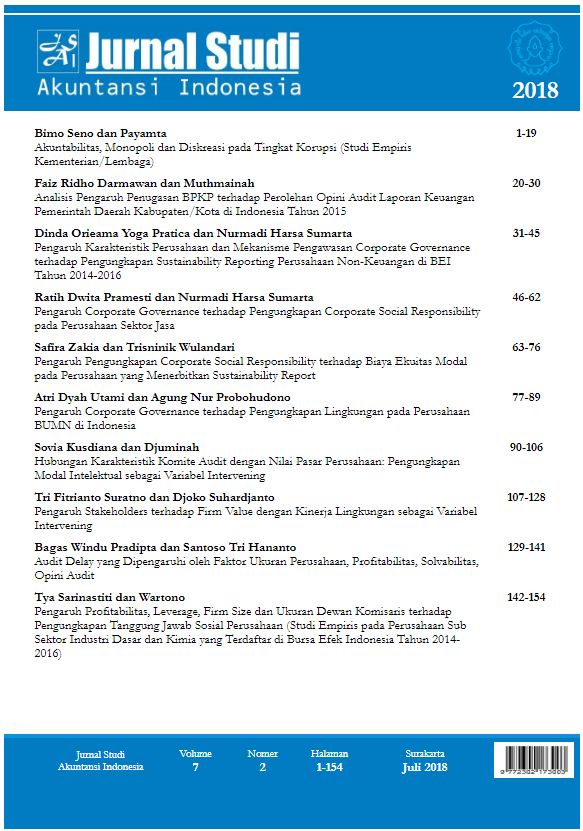

Bagas Windu Pradipta dan Santoso Tri Hananto

Abstract

The delay in financial reporting is not directly interpreted by the investor as a bad signal for a company. The goals of this research are: 1) To find out the empirical evidence about the firm size, profitability, size of the public accounting firm, solvency, and the auditor's opinion on audit delay. 2) To know the average of audit delay of the companies that listed on the IDX. The second data of research methodology that used in this research is the financial reports and audit reports of manufacturing companies that listed on the Indonesia Stock Exchange (IDX) in 2017. The sampling selection is based on three criteria: (1) the firms that listed on the IDX in the period 2017 and submitting financial reports for the period 2017; (2) financial reports are presented in rupiah currency (IDR); (3) manufacturing company in 2017. Result: 1) Audit delay not influenced firm size indicated by significance value (Sig t) equal to 0,122> 0,05. 2) Audit delay influenced by ROA is indicated by significance value (Sig t) equal to 0.000 <0,05. 3) Audit delay is not affected KAP size is indicated by the significance value of 0.604> 0.05. 4) Audit delay is not affected Solvency seen from the significance value of 0.131> 0.05. 5) Audit delay is not influenced auditor opinion with significance value 0.313> 0.05. 6) Audit delay is not influenced by ROE with significance value 0.132> 0.05.

Keywords

audit delay, company size, ROA, solvency, audit opinion, manufacturing company, ROE