Kembali | Vol 8, No 1 (2019)

Article

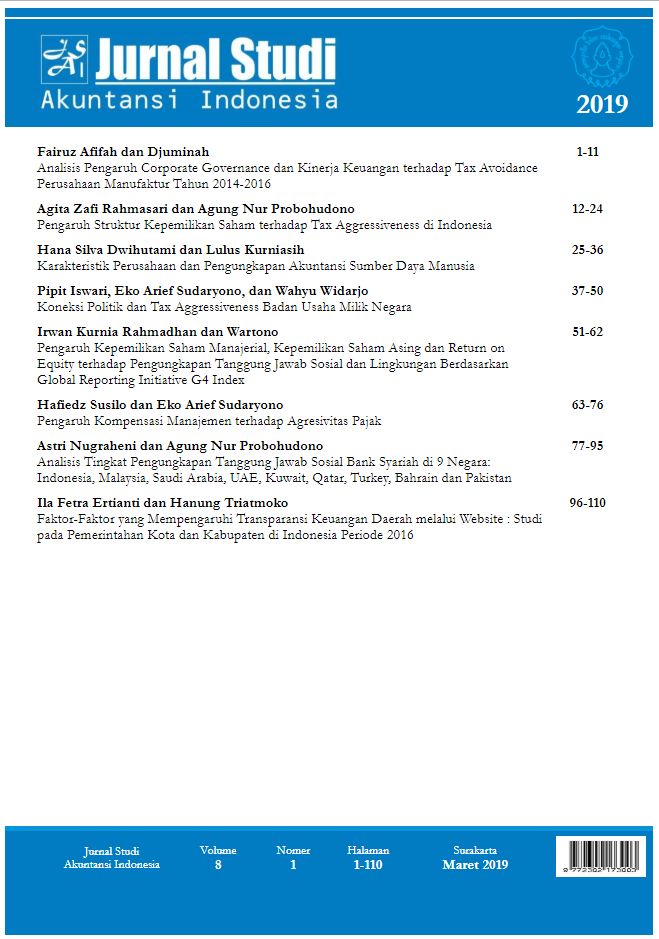

Agita Zafi Rahmasari dan Agung Nur Probohudono

Abstract

The main aim of this research is to examine the influences of ownership structures towards the companies’ tax aggressiveness. The samples used in this research consist of the companies listed in the Indonesia Stock Exchange in 2015-2016. Furthermore, the data used in this research is secondary data obtained from the companies’ financial reports and annual reports. This research is a quantitative research and the method of analysing the data is regression analysis. The tax aggressiveness was measured with Book Tax Differences (BTD) proxy. The result shows institutional ownership give no significant effect towards tax aggressiveness, while government ownership and foreign ownership give negative significant effects towards tax aggressiveness. The limitation of this research is the using of 2-year samples only that consist of companies in various sectors.

Keywords

Tax Aggressiveness, Ownership Structures, Book Tax Difference